Market Overview:

The pay tv market is experiencing rapid growth, driven by demand for premium and exclusive content, advancements in broadcasting technology, and bundling services for convenience. According to IMARC Group’s latest research publication, “Pay TV Market Size, Share, Trends and Forecast by Type, Technology Type, Application, and Region, 2025-2033”, the global pay TV market size was valued at USD 190.21 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 208.12 Billion by 2033, exhibiting a CAGR of 1.00% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/pay-tv-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Pay TV Market

- Demand for Premium and Exclusive Content

People love premium content like live sports, exclusive movies, and original series, which keeps the pay TV industry thriving. Viewers are drawn to channels offering unique programming, such as ESPN for sports or HBO for hit shows. For instance, over 80% of U.S. households with pay TV subscriptions value live sports and premium channels. Companies like DIRECTV have boosted this demand by partnering with Disney to include ESPN+, Disney+, and Hulu in select packages, enhancing viewer options. This focus on exclusive content meets consumer desires for high-quality entertainment, driving subscriptions. Government initiatives, like Nigeria’s launch of Silver Lake Television (SLTV), also promote competitive pricing, making premium content more accessible and fueling market growth. This trend ensures pay TV remains a go-to for must-watch programming.

- Advancements in Broadcasting Technology

New tech is a game-changer for the pay TV industry, making viewing experiences sharper and more interactive. Innovations like 4K resolution and smart TV compatibility have increased subscriptions, with over 60% of North American households now using smart TVs for pay TV services. Companies like Comcast are integrating AI to offer personalized recommendations, enhancing user engagement. Government programs, such as the U.S.’s BEAD initiative with $42.45 billion for high-speed internet, support better IPTV delivery. These advancements allow providers to offer seamless, high-quality streaming, appealing to tech-savvy viewers. By combining cutting-edge tech with user-friendly interfaces, the industry attracts new subscribers and retains existing ones, solidifying its place in the entertainment landscape.

- Bundling Services for Convenience

Bundling TV with internet and phone services is a big draw for consumers, making pay TV more appealing. Providers like AT&T offer packages combining pay TV with high-speed internet, with over 70% of U.S. subscribers opting for such bundles for cost savings. This strategy boosts retention, as seen with Comcast’s bundled offerings including Netflix and Hulu. Government policies, like India’s TRAI allowing customized channel selections, make these bundles more attractive by letting users pay only for desired content. This flexibility drives subscriptions, especially in regions like Asia-Pacific, where 35% of pay TV revenue comes from bundled services. By offering convenience and value, bundling keeps the pay TV industry competitive in a crowded entertainment market.

Key Trends in the Pay TV Market

- Rise of Hybrid TV Models

Hybrid TV models, blending traditional pay TV with streaming services, are reshaping the industry. Providers like Comcast now integrate Netflix and Amazon Prime Video into their platforms, with 40% of U.S. pay TV subscribers accessing OTT content through their set-top boxes. This trend caters to viewers wanting both live TV and on-demand options. For example, DIRECTV’s partnership with Disney allows seamless access to Disney+ alongside traditional channels. These models enhance user experience by offering a one-stop entertainment hub, boosting subscriber retention. In regions like Asia-Pacific, hybrid models are gaining traction, with 25% of pay TV users subscribing to bundled OTT services. This shift reflects consumer demand for flexibility, making hybrid models a key focus in pay TV industry analysis.

- Increased Personalization Through AI

AI is transforming the pay TV industry by delivering tailored content recommendations. Providers like Charter Communications use AI to analyze viewing habits, with 50% of their subscribers engaging with personalized suggestions. This tech enhances user satisfaction, as seen with Sky Group’s AI-driven interfaces that streamline content discovery. In Europe, 30% of pay TV platforms now incorporate machine learning for customized experiences. Real-world applications include targeted ads and curated channel packages, which increase viewer engagement. Government support, like the EU’s push for secure digital platforms, ensures these technologies meet privacy standards. This trend is pivotal in pay TV industry analysis, as personalization keeps providers competitive in a market where consumers crave unique, relevant content.

- Expansion into Emerging Markets

The pay TV industry is booming in emerging markets like Asia-Pacific and Africa, driven by rising incomes and better internet access. In India, pay TV penetration in rural areas has grown by 20% due to affordable packages from providers like Dish TV. Government initiatives, such as Egypt’s digital TV platform launch, support this expansion by improving infrastructure. In China, IPTV subscriptions have surged, with 15% of households opting for online models. Companies like Airtel India are tailoring content to local tastes, boosting subscriber numbers. This trend, critical in pay TV industry analysis, highlights how providers are tapping into new audiences with localized programming and flexible pricing, ensuring growth in diverse, underserved regions.

Leading Companies Operating in the Pay TV Industry:

- Bharti Airtel Limited

- DIRECTV (AT&T Communications)

- Dish Network Corporation

- DishTV India

- Fetch TV Pty Limited (Astro All Asia Networks)

- Foxtel (News Corp. Australia)

- Rostelecom PJSC

- Tata Sky Limited

- Tricolor TV

Pay TV Market Report Segmentation:

By Type:

- Postpaid

- Prepaid

Prepaid accounts dominate the pay TV market due to their flexibility and affordability, appealing to cost-conscious consumers and younger demographics who prefer convenience and control over their viewing habits.

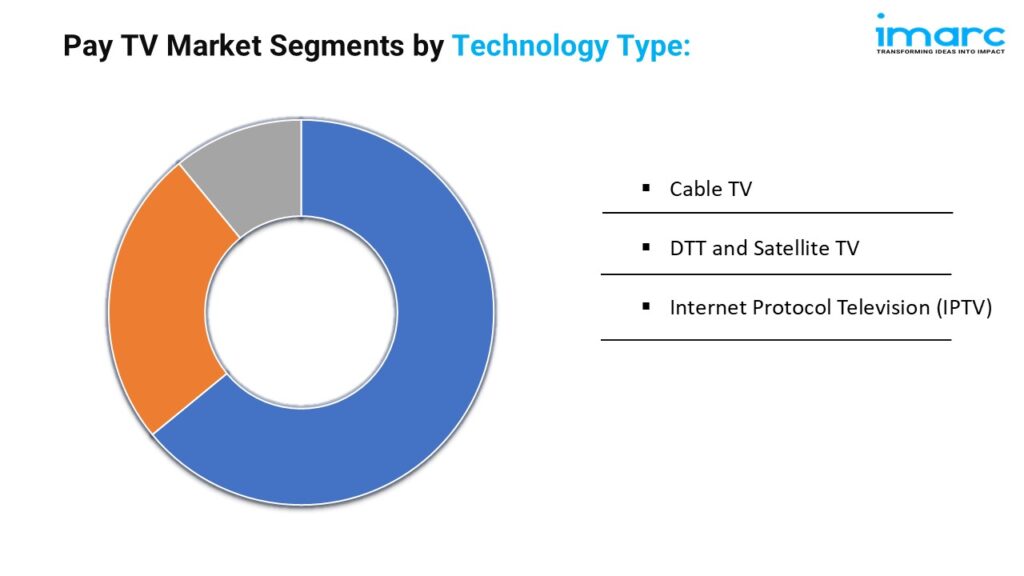

By Technology Type:

- Cable TV

- DTT and Satellite TV

- Internet Protocol Television (IPTV)

Cable TV leads with around 36.7% market share in 2024, benefiting from extensive infrastructure, reliable service, and established relationships with content producers, making it a dominant force despite the rise of digital platforms.

By Application:

- Commercial

- Residential

- Others

Residential accounts for about 74.6% of the pay TV market share in 2024, driven by high consumer demand for diverse entertainment options at home, with attractive subscription packages and technological advancements enhancing its appeal.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

In 2024, North America holds over 32.8% of the pay TV market share due to advanced digital infrastructure, high consumer spending power, and strong demand for premium content, supported by significant investments and strategic partnerships among providers.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145